5 The range is $137 billion to $379 billion, based on scenario analysis from McKinsey’s COVID-19 Epidemiological Scenario Planning Tool. The majority of these costs would be related to the prevention and treatment of COVID-19 cases as well as long COVID. Based on our estimates, endemic COVID-19 could result in healthcare costs of about $200 billion annually in the United States. Endemic COVID-19: Since the publication of our last article, COVID-19 has moved more and more toward an endemic stage.The growth will be partially offset by enrollment changes in the segment, prompted by a shift from fully-insured to self-insured businesses that could accelerate as employers facing recessionary pressure seek to cut costs. We expect profit pools in this segment to rebound and grow at a 15 percent CAGR as EBITDA margins will likely return to historical averages by 2026. Commercial segment margins in 2021 were about 200 basis points lower than 2019 levels, resulting from the return of deferred care. 4 Meghana Ammula and Jennifer Tolbert, “10 things to know about the unwinding of the Medicaid Continuous Enrollment requirement,” Kaiser Family Foundation, December 8, 2022. However, based on our models, Medicaid enrollment could decline by about ten million lives over five years given recent legislation that will allow states to begin eligibility redeterminations, which were paused during the federal public health emergency that was declared at the start of the COVID-19 pandemic. 3 “Moody’s analytics population projections,” Moody’s Investors Service, December 2022 Medicare Advantage penetration was increasing by less than 2 percent annually from 2016 to 2019 but increased by about 3 percent annually in 20-for further information, see “Medicare advantage/part D contract and enrollment data,” Centers for Medicare & Medicaid Services, US Government. Change in payer mix: A substantial shift toward Medicare will continue, led by growth in the over-65 population of 3 percent per year projected over the next five years and continued popularity of Medicare Advantage among seniors, as reflected in the latest Centers for Medicare & Medicaid Services (CMS) enrollment data.Going forward, a number of factors will likely influence shifts in profit pools. On the other hand, the outlook for some segments has worsened compared with our previous analysis, including general acute care and post-acute care within providers and Medicaid within payers. These assessments generally align with our earlier article’s conclusions.

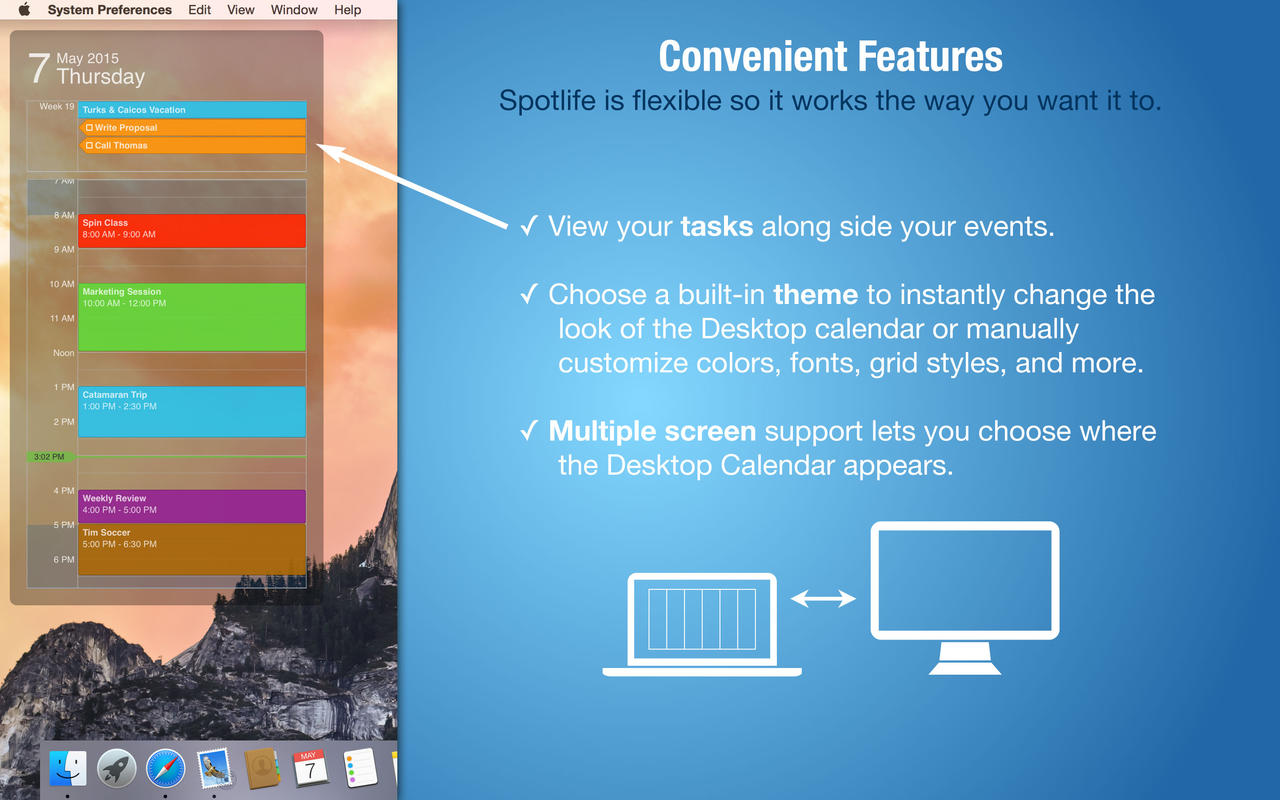

#Spotlife healthcare software#

Several segments can expect higher growth: Medicare Advantage within payers care settings such as ambulatory surgery centers within providers software and platforms (for example, patient engagement and clinical decision support) within HST and specialty pharmacy within pharmacy services. However, we expect improvement efforts to help the industry overcome these challenges in 2024 and beyond. The industry faces difficult conditions in 2023, primarily because of continuing high inflation rates and labor shortages.

Based on updated and expanded projections, we estimate that healthcare profit pools will grow at a 4 percent CAGR from $654 billion in 2021 to $790 billion in 2026 in our previous article, we estimated a 6 percent growth from 2021 to 2025.

0 kommentar(er)

0 kommentar(er)